Non-Performers Given Cover Charges in Basel Bistros

For further information on any of the issues discussed in this publication please contact the related contact(s) on this page.

BIS proposes new rules for NPLs to plug gap in regulatory capital regime for securitisation

This article is about the Basel Committee’s June 2020 proposed technical amendment to the securitisation rules relating to the capital treatment of securitisations of non-performing loans. Those professing a certain agility with the Committee’s Bistro mathematics1 may wish to skip to the final section – The New NPL Rules. For the rest of us, we have attempted to provide some basic context below.

So far this year we have penned a number of articles covering the European Commission’s regulatory regime for securitisation, consisting of Regulation (EU) No 575/2013 on capital requirements (the CRR), Regulation (EU) 2017/2402 (the Securitisation Regulation) and Regulation (EU) 2017/2401 amending the CRR (CRR Amendments Regulation and together with the legislation referred to above, the EU Securitisation Regime). We have emphasised the role that the Commission has given to securitisation in causing and deepening the global financial crisis (GFC) a dozen years ago as the context of many aspects of the EU Securitisation Regime. However, it is fair to say that most all legislation passed in Strasbourg and Brussels for the regulation of securitisation takes inspiration from the banks of a Swiss stretch of the river Rhine. The Basel Committee on Banking Supervision (BCBS) is a committee of banking supervisory authorities originally established by the central bank governors of the Group of Ten countries in 1974. The BCBS now has 45 members from 28 jurisdictions, consisting of central banks and financial regulators in each of them. The Committee's Secretariat is located at the headquarters of the Bank for International Settlements (BIS) in Basel. The business of securitisation is so intimately bound up with proceedings at the BCBS that executives reputedly named JP Morgan's 1997 ground breaking US$700m Bistro bond, the first synthetically funded collateralised debt obligation (CDO), after the Secretariat’s host.

As a supranational body without legislative authority in the jurisdictions of BCBS members, BIS regulatory frameworks are not law. Nevertheless, rules made by the BCBS have generally been adopted swiftly and largely wholesale across developed economies, particularly in North America and the European Union. This accords with the intention of BCBS members to avoid damaging regulatory arbitrage between their respective jurisdictions. Accordingly, the EU Securitisation Regime is based fairly and squarely on the Basel Securitisation Framework summarised below.

Evolution of Risk Weightings

The GFC prompted a root and branch examination by the BCBS of its regulatory capital regime for financial institutions in its member jurisdictions. This fundamental review resulted in a framework that was adopted in December 2010 and further revised and refined thereafter for a post-GFC capital regime accord (Basel III) establishing more stringent regulatory capital / own funds requirements and new minimum liquidity thresholds for banks.

Basel III represents an evolution of the risk-based capital regime adopted as the Basel I accord in January 1992 and Basel II in 2007. The basic principal underlying all three accords is that banks be required to reserve less capital against low-risk exposures while higher-risk exposures require more capital to be reserved against potential losses. The risk associated with a financial institution’s exposure to a particular asset is assessed by application of a risk weighting specified in the accord for the asset class to which it belongs.

Specifically, Basel III established financial coverage ratios requiring banks to maintain certain minimum amounts of capital (or to use the CRR term, own funds) to total risk-weighted assets (Capital Ratios), a certain minimum of capital to total assets (leverage ratio), and require banks to have high-quality investments and access to stable funding to meet their short-term and long-term funding obligations, i.e., sufficient liquidity. The Basel III Capital Ratios represent more stringent limits and a number of other adjustments to reflect the BCBS’s developing analysis of the GFC. For example, the minimum required common equity Tier 1 capital (essentially common stock or ordinary share capital, CET1) that banks are required to reserve is 4.5% (plus a 2.5% additional capital conservation buffer for European credit institutions) of total risk-weighted assets; the required ratio of all Tier 1 capital instruments to total risk-weighted assets including the capital conservation buffer is 10.5% and the total Tier 1 and Tier 2 capital (primarily common stock and certain preferred shares and subordinated debt) to risk-weighted assets (Equity Ratio) is 12.5%.

A risk weighting is a percentage assigned to various specified asset classes and exposure types applied as a multiplier to the relevant Capital Ratio to determine the amount of capital effectively required to be reserved for that particular position. These percentages generally range from 20% to 1,250% (or a deduction from CET1) translating to a minimum own funds requirement for a €100mm asset / exposure of €2.5mm and €100mm, respectively. Certain off-balance sheet or contingent liabilities allow application of an additional multiplier, referred to as a conversion factor, further reducing the amount of capital that needs to be held against the exposure.

A Hierarchy of Approaches

The methodology that Basel III contains to determine the risk weighting of what are referred to as ‘securitisation positions’ in effect since January 2018 (the Basel Securitisation Framework) is particularly complex. In fact, the topic of what might and might not constitute a securitisation position for the Basel Securitisation Framework and how that differs from the definition of securitisation in the EU Securitisation Regime is worthy of its own treatise and beyond the scope of this article. Nonetheless, the most salient feature of both Framework and Regime is a hierarchy of approaches to be adopted by financial institutions in arriving at a risk weighting percentage for a particular securitisation position. Note however, that the hierarchy applies only to securitisations that are not re-securitisations (i.e., securitisations of securitisation positions, such as a CDO2), which retain pariah status under the Basel Securitisation Framework and by extension, the EU Securitisation Regime.

Fig.1 Basel Framework Hierarchy

The Basel Securitisation Framework has the Securitisation - Internal Ratings-Based Approach (SEC-IRBA) at the top of the hierarchy of approaches (see Figure 1, the Basel Hierarchy). To use the SEC-IRBA, banks must have a supervisory-approved (i.e., in the case of European credit institutions, approved by their national competent authority (NCA)) internal ratings-based (IRB) model for the type of underlying exposure in the securitisation pool and sufficient information to estimate the capital charge for these underlying exposures. This key bank-supplied input is denoted KIRB, which is the risk-weighted capital requirement for exposures assessed under the IRB model.

The External Ratings-Based Approach

For some financial institutions (including many investment managers) the SEC-IRBA may be unavailable. This could be because the regulator does not consider that its risk management function has reached the required level of sophistication for the asset class. Or perhaps it has insufficient expertise and data relating to the type or geography of the assets in the pool. In these circumstances, the investor may consider application of the SEC-ERBA, based on the credit ratings awarded by external credit rating agencies to the particular tranche under consideration. In the EU, the credit rating agencies and award of the rating must be compliant with the European Commission’s 31 May 2013 amending regulation making several significant changes to the existing Credit Rating Agencies Regulation (EC) No 1060/2009.

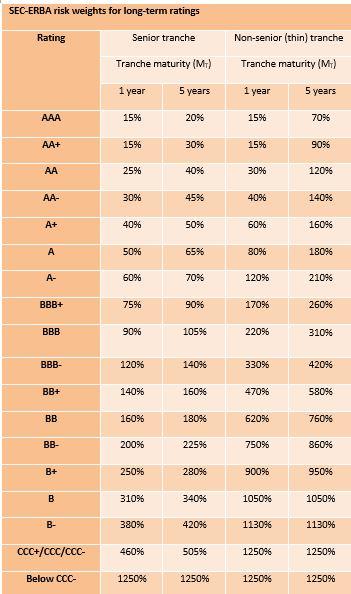

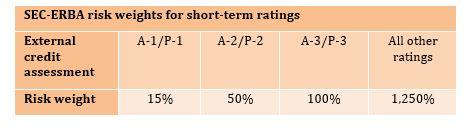

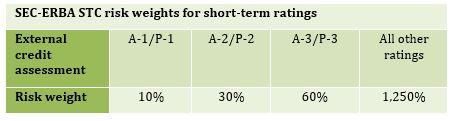

For exposures with short-term ratings, the risk weights in Table 1 apply, whereas for exposures that have at least twolong-term ratings, the risk weights in Table 2 are used.

Table 1:

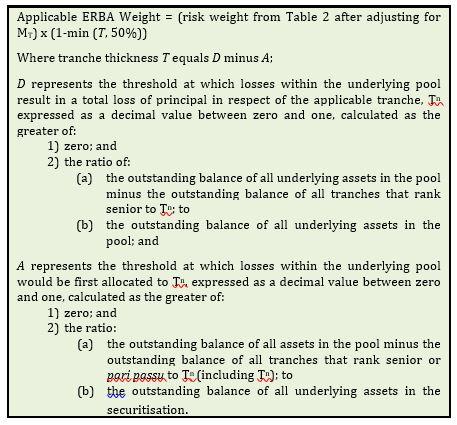

The risk weight percentage is modified for the maturity or MT, of the securitisation position (see our article: https://www.dilloneustace.com/legal-updates/its-a-wonderful-weighted-average-life. Where MT falls between 1 and 5 years, a linear interpolation between the two applicable risk weights is used. Tranches with an effective maturity longer than five years are treated as having an MT of 5.00. The long-term SEC-ERBA risk weights are also modified for tranche thickness. For non-senior tranches (broadly, that are not the most senior tranche of securities in the transaction), the risk weight is further modified for tranche thickness by applying the following formula:

Simply put, the thicker the subject tranche, Tn as a proportion of the capital stack, the greater the quantum of principal losses Tn can absorb before being wiped out. The greater the difference between the attachment point, A and detachment point, _D_of losses for Tn, the higher the value for thickness, T. The risk weight in the cell of Table 2 applicable to Tn (the Applicable ERBA Weight) is multiplied by 1-T to reduce the Applicable ERBA Weight for thicker tranches, subject to a floor, or minimum of 50% of the Applicable ERBA Weight. Accordingly, all other things being equal, a thick 50% 5 year BBB tranche will halve the Applicable ERBA Weight of 310% to 160%, whereas a thin 10% tranche will only reduce it to 279%. Figure 2 is a visual representation.

If neither of the SEC-IRBA or the SEC-ERBA (SEC-IAA in the case of asset-backed commercial paper (ABCP) positions) can be used because Tn has no recognised credit rating and it is not possible to infer one from ratings of other tranches subordinated to Tn collateralised by the same pool, then the bank will need to move down the Basel Hierarchy to the standardised approach (SEC-SA). SEC-SA applies a risk-weight based on the underlying capital requirement that would apply under the standardised approach for non-securitisation credit risk, and other risk drivers. In principal therefore, the SEC-SA is even more conservative than the SEC-ERBA, because it ignores credit risk mitigation features inherent in securitisation structures such as the portfolio effect and credit enhancement and liquidity support provided by subordinate tranches.

Fig.2 Calculating Tranche Width T

Nevertheless, although less anomalous than under Basel II and there is more graduation of risk weights for lower rated exposures under the SEC-ERBA of the Basel Securitisation Framework, it is still possible for unrated tranches under the SEC-SA to receive lower risk weights than some rated tranches under the SEC-ERBA.

If none of the approaches in the three levels of the Basel Hierarchy can be used, then the financial institution must assign a risk-weight of 1,250% to the securitisation position.

STS ≠ STC?

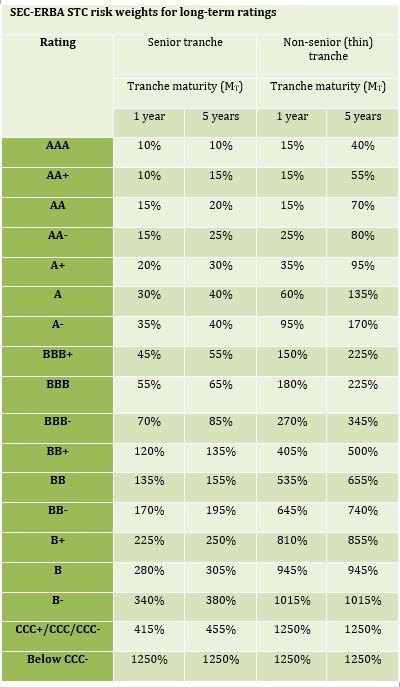

The impetus for treatment of simple, transparent and standardised (STS) securitisations under the EU Securitisation Regime – see our article: https://www.dilloneustace.com/legal-updates/securitisation-regulation-update-new-regulatory-technical-standards-on-homogeneity – originates from provisions for more favourable regulatory capital treatment of simple, transparent and comparable (STC) securitisations under the Basel Securitisation Framework. Although the criteria for qualifying as STS securitisations are significantly more detailed and asset class specific than those for STC securitisations, the Basel Securitisation Framework establishes discounted risk weights under SEC-ERBA for STC positions. The lower risk weights for short term rated and long term rated STC exposures are reproduced in Tables 3 and 4 respectively.

Table 3:

Notably, Annex 2 to the Basel Securitisation Framework sets out limited homogeneity, underwriting and other criteria for the securitised pool as well as those for the interest basis of securitised assets. Nonetheless, in the EU, the bulk of requirements for origination and valuation, interest rate and other hedging, granularity, document disclosure, transparency and reporting and the like are left to the STS criteria in the EU Securitisation Regime. Remarkably, the STC criteria contemplate commercial mortgage-backed securities (CMBS) transactions that are compliant, whereas the STS criteria exclude them completely. At the moment, both sets of criteria exclude synthetic securitisations (see: https://www.dilloneustace.com/legal-updates/is-synthetic-securitisation-about-to-be-brought-in-from-the-cold).

The New NPL Rules

Since the GFC, non-performing loan (NPL) securitisations have played an important part in global asset-backed securities (ABS) markets, most prominently in Ireland and Southern Europe. To date however, NPL transactions have gone very largely ignored by the Basel Securitisation Framework. Recognising this regulatory lacuna and that “…securitisations of non-performing loans are subject to different risk drivers compared to securitisations of performing assets, which points to a need for a specific treatment to reflect these differences in a risk-sensitive and conservative way…”, the BCBS last month published a technical amendment paper on the regulatory capital treatment of securitisations of NPLs: (https://www.bis.org/bcbs/publ/d504.pdf) (the NPL Rules).

The NPL Rules contain an interesting warning that these transactions in particular may not fall within the definition of a securitisation for the purposes of the Basel Securitisation Framework and that institutions should check with their NCA that the relevant exposure falls within scope. Nevertheless, where an NPL securitisation position does fall under the Basel Securitisation Framework, it is to be supplemented in the following ways:

A standardised definition of NPL securitisations is to be established, being securitisation transactions where at least 90% of assets in the portfolio are in default, either at inception or at any other time in the life of the deal as a result of acquisition, disposal, substitution or restructuring. Re-securitisations are expressly excluded from qualifying as NPL securitisations. The 90% threshold is stated to be a minimum standard and that national supervisors should be able to implement stricter criteria, in particular with the overriding objective of preventing regulatory arbitrage. Accordingly, NCAs may increase the threshold above 90% and / or finesse the definition of what does or doesn’t constitute a non-performing asset, in order to prevent institutions from improperly including assets that would otherwise attract a higher risk weighting.

A ban on the use of foundation IRB parameters as inputs for the SEC-IRBA for all NPL securitisations. By way of explanation, for certain asset classes, the BCBS has made available two broad IRB approaches: a foundation and an advanced approach. Under the foundation approach (F-IRBA), as a general rule, banks provide their own estimates of probability of default (PD), but rely on their NCA’s supervisory estimates for other risk components. Under the advanced approach (A-IRBA) approach, banks provide their own estimates of PD, loss given default (LGD) and exposure at default (EAD), and their own calculation of effective maturity (M), subject to meeting minimum standards. For both the F-IRBA and A-IRBA, banks must always use the risk-weight functions provided in Basel Securitisation Framework for the purpose of deriving capital requirements. Consequently, financial institutions wishing to use the SEC-IRBA to determine regulatory capital requirements for NPL securitisation exposures, must be recognised by their NCA as meeting the minimum standards to apply the A-IRBA. Otherwise, they will be obliged to follow the Basel Hierarchy down to the SEC-ERBA.

The introduction of risk weight floor of 100% for all NPL securitisation exposures.

Introduction of a fixed 100% risk weight applicable to the most senior tranche of qualifying NPL securitisations, where “qualifying” refers to traditional (what the BCBS calls non-synthetic, “true sale”) securitisations in which the non-refundable purchase price discount (NRPPD) is equal to or larger than 50% of the aggregate outstanding principal amount of the NPLs in the securitised pool. NRPPD is essentially the discount applied to the nominal or outstanding value of the NPL portfolio when the NPLs are acquired from the original lender, originator or sponsor by the issuer of tranched ABS. Senior tranches backed by a pool of NPLs acquired for a total purchase price of more than 50 cents in the euro will not therefore be eligible for the fixed 100% risk weight on the senior tranche.

In conjunction with the foundation IRB parameters ban and the 100% risk weight floor, the current provisions of the Basel Securitisation Framework continue to apply to all other exposures to NPL securitisations (i.e., senior tranches of non-qualifying NPL securitisations, and mezzanine and junior tranches of all NPL securitisations); and

Financial institutions that are allowed under the current rules to apply a maximum capital requirement for their securitisation exposures in the same transaction can continue to apply the same maximum capital requirement as applicable under current rules. This applies to originator and sponsor entities as well as bank investors using the SEC-IRBA.

The BCBS is proposing that the NPL Rules be implemented by member jurisdictions by no later than 1 January 2023, which could be mistaken for the distant future. However, the BCBS has invited comments on the draft NPL Rules linked above no later than 23 August 2020, so there is a limited timeframe for stakeholders to react meaningfully. Nevertheless, in the current economic climate and with Basel’s bistros still subject to COVID-19 restrictions, this is a welcome and comforting initiative.

1 See The Hitchhiker’s Guide to the Galaxy, by Douglas Adams

DISCLAIMER: This document is for information purposes only and does not purport to represent legal advice. If you have any queries or would like further information relating to any of the above matters, please refer to the contacts above or your usual contact in Dillon Eustace.

Copyright Notice: © 2025 Dillon Eustace LLP. All rights reserved.